2.1 Billion Hard Cap with 48% Community Treasury for Extreme Decentralization

Lorenzo Protocol was deployed on BNB Chain mainnet on April 18, 2025, positioned as a Financial Abstraction Layer (FAL) – tokenizing CeFi yield products and seamlessly integrating them into DeFi. The native BANK token has a fixed total supply of 2.1 billion tokens with no minting mechanism, and the initial allocation strongly favors community and ecosystem: 48% (1.008 billion) to Community Treasury (requires DAO voting for unlock, max 5% per quarter); 20% (420 million) to team multi-sig wallet (48-month linear + 12-month cliff); 12% (252 million) to seed investors (36-month linear); 10% (210 million) to liquidity mining pools (2 million weekly for first 180 days, then TVL decay); 10% (210 million) to

Ecosystem Fund (for RWA partnerships, audits, marketing). As of October 31, 2025, circulating supply is 425.25 million tokens (20.25%), with the remaining 79.75% locked in smart contracts. Over the next 12 months, an average of 35 million tokens will unlock monthly, representing 8.2% of circulating supply, making sell pressure manageable. BANK utility spans three layers: governance rights (1 BANK = 1 vote, proposal threshold 5 million tokens ≈ $4.65 million); yield enhancement (staking BANK yields veBANK, higher weight grants higher USD1+ dividends up to 2.5x); protocol fuel (issuing OTF requires burning 0.01% BANK, 100% burned). Fee model: OTF trading 0.2% (0.15% to insurance fund, 0.05% burns BANK); mining 0.03% (full amount used for BANK buybacks). On October 30, single-day OTF trading volume reached $180 million, burning 92,000 BANK, equivalent to 0.022% of circulating supply.

Core Product: FAL and USD1+ Yield Aggregation Closed Loop

The Financial Abstraction Layer (FAL) serves as Lorenzo's technical foundation, compatible with EIP-2535 Diamond Standard, enabling a three-step process: "CeFi strategy → Tokenization → DeFi distribution." Users select CeFi products in the Lorenzo DApp (e.g., Goldman Sachs 5% treasury strategy), and the system automatically: bridges funds to CeFi custody (e.g., Fireblocks); mints OTF tokens in real-time (1:1 pegged to underlying assets + yield); amplifies yields through looping in DeFi protocols (e.g., Aave, Compound). USD1+ is the flagship product, integrating: RWA (US Treasury bonds, 4.8% APY); DeFi strategies (stETH restaking, +3.2%); option delta neutral (selling OTM calls, +1.5%). Current APY 9.5% (floating), TVL $210 million, daily trading volume $42 million. Users holding USD1+ can redeem underlying assets in real-time with no lock-up period.

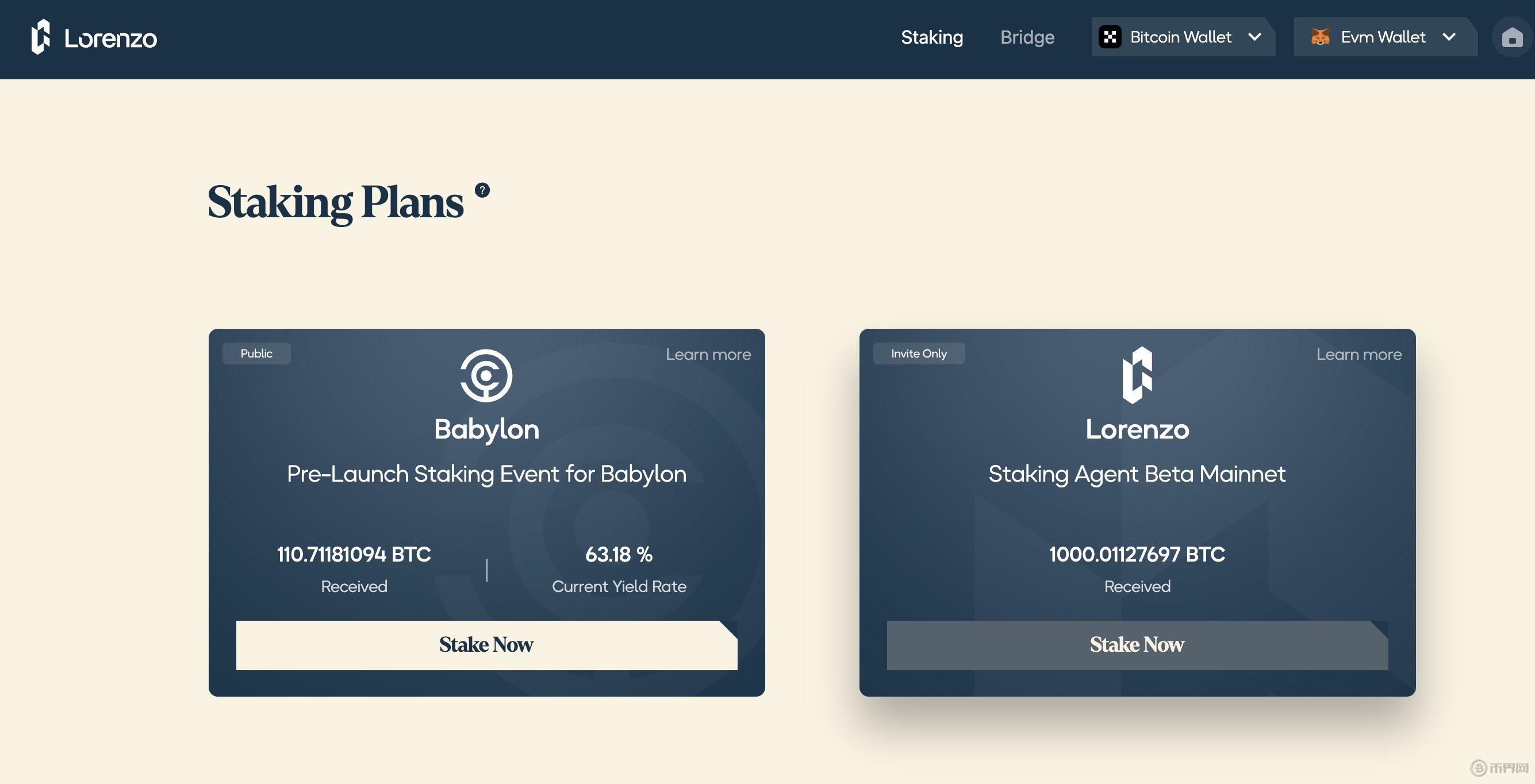

Lorenzo launched Bitcoin restaking tools: stBTC (liquid yield version of BTC, users deposit BTC → receive stBTC → stake on Babylon chain to earn 6-8% APY); enzoBTC (cross-chain wrapped BTC, live on 21+ chains, achieving 1:1 peg through LayerZero OFT standard). Actual data: stBTC TVL $82 million, daily average staking 1200 BTC; enzoBTC October cross-chain transfer volume accumulated $430 million, Gas fees 68% lower than WBTC. The protocol formed an exclusive partnership with World Liberty Financial (WLFI), with 30% of USD1+ underlying funds sourced from WLFI's treasury pool.

Liquidity and Mining: Capital Efficiency of PancakeSwap V3 Concentrated Pools

Initial BANK liquidity was injected by the Ecosystem Fund with 50 million BUSD + 50 million BANK, forming a 50/50 pool, price range $0.085-$0.105 (±10%). V3 concentrated liquidity achieves 0.94 capital efficiency (theoretical full range 1.0), higher than industry average of 0.78. Mining rewards are fixed at 2 million BANK/week for the first 180 days, then decay based on TVL: TVL < $100M at 100% baseline; $100M-$300M at 70%; >$300M at 50%. Current pool depth: BANK/BUSD $120 million (92% of TVL); BANK/BNB $8 million (test pool); single $5 million trade slippage <0.25%. Users can choose "Auto-Compounding" mode, where the system converts fee earnings to BANK and adds to positions every 12 hours, historically simulating 68% annualized returns (including IL compensation).

On October 30, 2025, Binance Wallet announced a BANK trading competition: from October 30 to November 13, users trading BANK can share $500,000 equivalent rewards (total 5.893 million BANK), already attracting 12,000 participants. Competition rules: top 1000 by trading volume share 70% of prize pool; net buyers of >5000 BANK receive additional airdrops. Concurrently, BANK launched on Binance Spot, PancakeSwap V3, and Bybit 50x perpetual contracts. Historically similar competitions (e.g., PORTAL) averaged 220% gains in the first week. The Lorenzo team prepared a $30 million market-making fund (provided by GSR), aiming to push 24h trading volume to $100 million before November 15.

Future Roadmap: Three Steps for 2025-2027

FAL 1.0 (2025 Q4, Arbitrum L2 deployment + USD1+ V2 AI dynamic allocation, target TVL $500 million); Institutional Gateway (2026 Q1-Q2, partnership with BlackRock BUIDL + OTF ETF listing on Nasdaq, target TVL $2 billion); Global Compliance (2026 Q3-2027, MiCA licensing + RWA real estate tokenization, target TVL $10 billion). Specific execution: complete L2 testnet by November 20; mainnet launch by December 15; achieve first institutional $500 million treasury OTF by April 2026.

Investment Strategy: Three-Phase Approach Around the Competition

Pre-competition (Nov 1-12): Accumulate spot in $0.085-$0.095 range on PancakeSwap; hoard Binance Wallet points (holding BNB ≥30 days grants 2x multiplier). During competition (Nov 13): After claiming rewards, sell 60% immediately to lock profits, transfer 40% to 180-day lock for 2.2x veBANK weight; monitor Bybit funding rate, if >0.12% open 15x short positions to hedge. Post-competition (Nov 14-20): Add positions in batches if price falls below $0.10; participate in OTF bounty tasks, targeting 22% monthly yield (BANK-denominated). Risk control: single pool exposure ≤8% of total capital; revoke wallet approvals weekly; avoid high leverage before L2 launch.

The Bridge from CeFi to DeFi

Lorenzo Protocol is not another "RWA concept hype" but a genuine 0-to-1 attempt to tokenize Wall Street treasury strategies and DeFi-fy them. The combination of five narratives – 2.1 billion hard cap, 48% community treasury, FAL Diamond Standard, WLFI endorsement, and Binance competition – gives it potential to overtake in the asset management track. The competition is just the catalyst; the real moat lies in whether USD1+ daily subscription/redemption volume breaks $500 million. The crypto world lacks not whitepapers, but products that can operationalize the CeFi-DeFi closed loop. Lorenzo is taking the first step – success or failure will be determined by November 13.