Ethena founder Guy Young clarified on platform X that this was not a genuine protocol-level depegging but a localized issue caused by a malfunction in Binance's internal oracle pricing.

USDe's minting and redemption mechanisms operated normally throughout, processing over $2 billion in redemption requests (including $1 billion in instant redemptions) within 24 hours without any interruption. Third-party audits (Chaos Labs, LlamaRisk) showed the protocol held $66 million in excess collateral, with unrealized profit further boosting the collateral ratio, confirming the system's stability

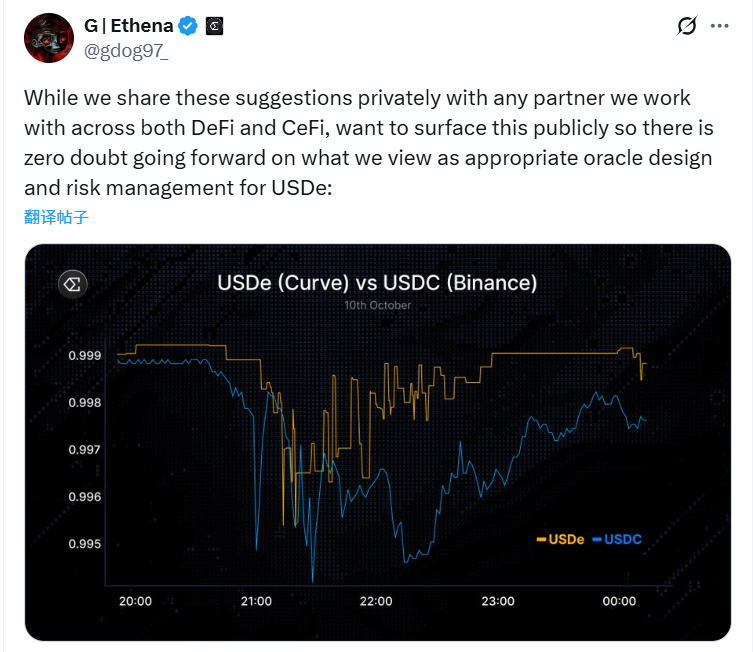

The primary reasons for the depeg included: Binance using its internal spot price as the oracle feed instead of external sources like Chainlink

a suspected attacker dumping $90 million worth of USDe, triggering cascading liquidations in the billions; and Binance freezing deposits and withdrawals, which hindered arbitrage. Post-event, Binance acknowledged the oracle flaw, committed to compensating $283 million in losses, and promised to optimize its price mechanism.

Regarding market impact, USDe's supply dropped from $14 billion to between $6-9 billion. The price of ENA fell 40%-43% before rebounding 18%-20%, currently around $0.4056 (as of October 13, 2025), with a market cap of $2.9 billion. Curve liquidity grew by 18%, and USDe quickly regained its peg. Community sentiment shifted from negative to neutral/optimistic (X sentiment score 87/100), with some users viewing the volatility as a risk-free arbitrage opportunity. Unlike the collapse of Terra UST, USDe's over-collateralization and Delta Neutral strategy ensured stability. As Frax founder Sam Kazemian stated, a stablecoin's peg is defined by 1:1 redemption, not its price on a single market.

The Ethena Protocol: An Innovative Benchmark for DeFi Stablecoins

Ethena is an Ethereum-based DeFi protocol aiming to create an internet currency independent of traditional banking. Its core products include USDe (a synthetic dollar stablecoin with a market cap of approximately $12.4 billion and TVL over $16 billion), sUSDe (a staked version with 9%-19% APY), and USDtb (a compliant stablecoin launched in July 2025 in partnership with Anchorage Digital, with a scale of $1.5 billion). USDe maintains its 1:1 dollar peg by collateralizing assets like ETH and BTC and hedging risk via perpetual futures contracts. Its Delta Neutral strategy combines collateral appreciation with short position hedging to offset market volatility, with the funding rate providing stable yields for sUSDe.

ENA is Ethena's governance token, with a total supply of 15 billion tokens and 7.156 billion in circulation (approximately 48% unlocked). Holders can participate in DAO governance (e.g., adjusting risk parameters), stake sENA to share protocol fees (15%), and receive airdrop rewards. In June 2025, ENA introduced a Restaking mechanism, integrating with Symbiotic to support cross-chain USDe transfers (e.g., via LayerZero protocol).

Ethena achieved several milestones in 2025: revenue surpassed $100 million in January, with USDe's market cap reaching $6.17 billion; a mandatory lock-up of 50% for unstaked ENA was introduced for airdrop claims in June; ENA price rose 43% in July, activating the Fee Switch, and USDtb was issued; the sUSDe HyperEVM fixed-income pool launched in September, offering 19% APY; and partnerships with Copper.co and Securitize were formed in October to expand custody and tokenized asset services.

Impact of the Depegging Event on Ethena and Its Response

The depegging event led to a decrease in USDe supply, but the TVL remains over $16 billion, with Curve liquidity growing by 18%. The ENA price faced short-term pressure (RSI 34.4) but was supported by a daily $10 million buyback plan and CEX listings (e.g., Kraken), leading to a rebound. The community acknowledged the efficiency of USDe redemption channels and audit transparency, with X sentiment turning neutral/optimistic.

On October 12, reports on the oracle design and collateral were released, confirming uPNL gains and over-collateralization; recommendations were made for exchanges to adopt external oracles like Chainlink; and optimizations for liquidity pool design are planned for Q4. The event also accelerated the expansion of white-label services, such as Jupiter's JupUSD, supporting multi-chain ecosystems like Sui, Avalanche, and TON.

Compared to USDT (centralized), DAI (over-collateralized), and UST (algorithmic), USDe's Delta Neutral strategy balances stability and yield. The event did not trigger systemic risk, performing better than the UST collapse.

Ethena's Future: A Bridge Between DeFi and TradFi

Ethena holds about 8%-10% of the stablecoin market share, projected to reach 12% by the end of 2025 (market cap over $20 billion). The ENA price may fluctuate between $0.146 and $0.90 short-term, potentially reaching $3 long-term (by 2030). In partnership with Securitize, Ethena is advancing the tokenized asset market (WEF predicts $4 trillion by 2030). Q4 will see the launch of JupUSD (on Solana) and USDi (on Sui). USDtb's compliance attracts institutional capital, and Copper.co integration simplifies custody processes.

How to Participate in the Ethena Ecosystem

Users can collateralize ETH to mint USDe via app.ethena.fi, stake sUSDe for yield; trade ENA on exchanges or provide liquidity on Uniswap; stake ENA to participate in governance and airdrops. It is essential to monitor market volatility and unlock schedules and use multi-signature wallets for security.

The USDe depegging incident was a market stress test that highlighted the Ethena protocol's resilience. Its Delta Neutral strategy, over-collateralization, and transparent governance withstood the challenge, contrasting with the Terra UST collapse. Through USDe, sUSDe, and USDtb, Ethena is building an efficient ecosystem, reshaping internet money. The ENA token offers users governance and yield opportunities. With accelerating cross-chain expansion and institutional partnerships, Ethena is poised to become a leader in the stablecoin space. Investors can participate through minting, staking, or trading but must remain cautious of market and regulatory risks. Ethena's vision of an internet bond, connecting DeFi with traditional finance? This event is merely the beginning of its journey.