Fundamental Value Re-rating: The Strategic Significance of the $17M Institutional Allocation

The recent driving force behind BNB has extended far beyond the Binance ecosystem itself, formally entering the consideration set of macro financial assets.Institutional Endorsement and Liquidity Upgrade

Capital Flows: A Signal of Macro Asset Allocation

Capital Flows: A Signal of Macro Asset Allocation

The announcement by the publicly listed company Applied DNA Sciences (NASDAQ: APDN) that it has allocated over $17 million to BNB is a decisive signal of BNB's shifting status.

This action is not short-term speculation but a strategic allocation as part of its balance sheet. Within the cryptocurrency market, only a very select few assets (like BTC, ETH) receive this treatment. This indicates that traditional institutions now view BNB as:

A Qualified Risk Asset: Possessing long-term allocation value and liquidity.

A Core Platform Asset: Featuring robust value capture mechanisms.

This spot buying from traditional institutions represents a long-term, stable capital flow driving BNB's value re-rating, providing a solid floor for the price and standing in stark contrast to the volatility induced by short-term leverage.

The Leverage Trap and Purge: The $138 Million Deleveraging Shockwave

Despite strong fundamental tailwinds, BNB's market structure exhibited clear short-term fragility, stemming from excessive leverage among retail and ordinary traders.

Quantifying Leverage and Sentiment: Fragility from FOMO

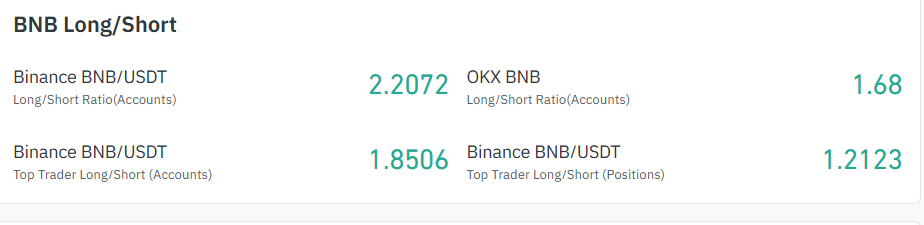

Data shows BNB's long/short ratio is significantly above 1, reaching 1.8506 on Binance specifically. This figure indicates a market gripped by highly bullish, FOMO-driven sentiment, where longs dominate. However, it also signifies a massive buildup of leveraged positions, making the market extremely sensitive to sudden selling pressure.

Technical Resilience Behind the V-Shaped Reversal

The candlestick chart shows that after rebounding from the low of $1,052, the price climbed steadily in a structured, step-like manner, breaking previous highs. This indicates:

Presence of Strong Buying: Institutional spot buying (corresponding to the $17 million allocation) utilized the brief low-liquidity window created by long liquidations to acquire at very low cost.

Transfer of Holdings: Market holdings have successfully transferred from weak leveraged longs to conviction-driven spot buyers, resulting in a more solid and healthy market structure.

The Caution and Rationality of Whale Sentiment

Although the long/short ratio for Top Trader accounts (1.6767) still shows a bullish bias, their position long/short ratio (1.2019) is markedly lower than that of regular retail accounts (1.8153). This suggests that whales are operating more cautiously and rationally; they are likely waiting to accumulate at lower prices post-liquidation rather than blindly chasing the rally with high leverage. This is further evidence of a successful, institution-driven market washout