Features of SnapX

Automated DeFi Strategies: SnapX provides AI-recommended strategies for liquidity mining, arbitrage, and yield optimization, allowing users to participate without needing an in-depth understanding of complex DeFi protocols. For instance, users can select a "Low-Risk Yield" strategy through a one-click interface, with the AI automatically allocating funds to high-return liquidity pools.

Data-Driven Market Predictions: SnapX leverages on-chain data (such as trading volume, Gas fee fluctuations) and off-chain data (such as market sentiment, macroeconomic indicators) to provide users with price trend predictions and investment advice through machine learning models. This feature is particularly attractive to novice users unfamiliar with technical analysis.

Decentralized Governance: SnapX employs a DAO (Decentralized Autonomous Organization) mechanism, allowing the community to vote on platform development directions, such as protocol upgrades, fee distribution, and ecosystem expansion. This community-driven model enhances user participation and sense of belonging.

The Multifaceted Role of $XNAP

$XNAP is the native token of the SnapX ecosystem, integrating utility, incentives, and governance functions:

Users use $XNAP to pay for transaction fees, AI analysis service fees, and Gas costs on the platform. A portion of these fees is redirected back to liquidity pools, enhancing the ecosystem's sustainability.

By staking $XNAP, users can earn esXNAP (a reward token), designed to incentivize long-term holding and ecosystem participation. The staking Annual Percentage Yield (APY) is projected to be between 10%-20%, depending on market conditions.

$XNAP holders can participate in the SnapX DAO, voting on key proposals such as new feature development, cross-chain integrations, or community incentive programs. This mechanism ensures transparency and fairness in platform development.

A portion of $XNAP is used to reward liquidity providers, developers, and community contributors, such as users participating in testing, promotion, or code submission.

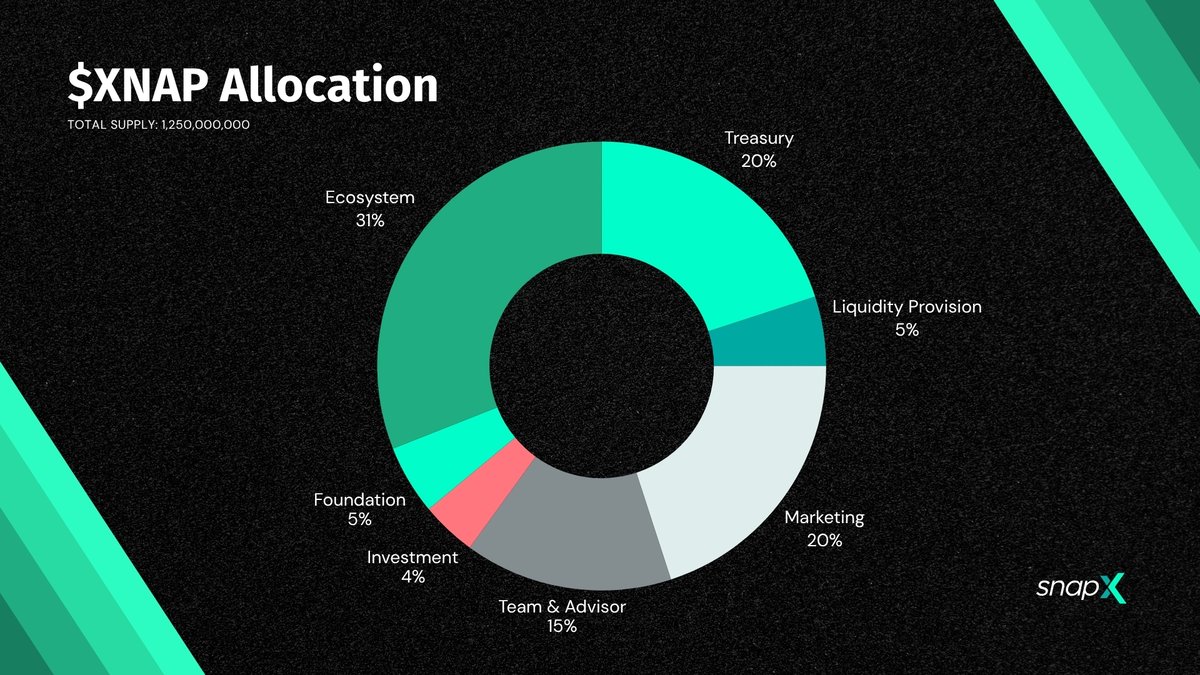

According to the SnapX whitepaper, the total supply of $XNAP is 1 billion tokens, allocated as follows: 40% for Community & Airdrops, 30% for Ecosystem Development (e.g., technical R&D and marketing), 20% allocated to the Team (vesting over 4 years), and 10% for Strategic Reserve (e.g., institutional partnerships or emergency funds). This tokenomics design aims to balance short-term incentives with long-term value stability, while reducing market selling pressure through vesting mechanisms.

AI-Powered Competitive Edge

SnapX's core competitiveness lies in the deep integration of AI and DeFi. Traditional DeFi platforms (like Uniswap, Aave) rely on static rules and manual user operations, which are less efficient and user-unfriendly for beginners. SnapX provides dynamic optimization through AI, for example:

Smart Order Routing can analyze liquidity across chains like Ethereum and Solana in real-time, reducing transaction costs, outperforming Uniswap V3's AMM model.

The AI-optimized interface simplifies operational processes, such as one-click staking and yield tracking, challenging the complexity of platforms like PancakeSwap.

Compared to competitors, SnapX's unique positioning lies in its AI-driven intelligence and user-friendliness. For instance, Uniswap excels in liquidity provision but lacks intelligent optimization; AI projects like focus more on data markets rather than DeFi trading. This differentiation positions SnapX advantageously within the trends of DeFi 2.0 and AI + Blockchain.

Binance Alpha Launch: Market Frenzy and Airdrop Buzz

On October 27, 2025, $XNAP officially launched on the Binance Alpha platform, accompanied by a simultaneous airdrop campaign, quickly igniting market enthusiasm. Data from platform X indicated that $XNAP rose by 11.85% within the first hour of trading, with the initial price fluctuating between $0.03 and $0.05. Market analysts predicted that if trading volume continues to amplify, the price could break through $0.10-$0.12 in the short term, potentially even reaching $0.15 amidst speculative fervor. Reports suggested that major exchanges like Kraken, OKX, and Coinbase might list $XNAP in the coming weeks, further enhancing its liquidity and global exposure.

The airdrop campaign on Binance Alpha provided a low-barrier opportunity for early adoption of $XNAP. Users could claim $XNAP tokens by completing tasks (such as trading, social media interactions, inviting friends) or by holding Alpha Points. The airdrop size is estimated to be 5%-10% of the total supply, aimed at attracting new users and expanding SnapX's community base. Users on platform X have already shared guides, noting that the "airdrop has a low threshold, but the window might only last 48 hours, suggesting participation as soon as possible." Furthermore, SnapX plans to continuously incentivize the community through follow-up events (like liquidity mining competitions) to enhance user stickiness.

$XNAP Investment Potential: Opportunities and Challenges

The launch of $XNAP coincides with a dual hype wave around AI and DeFi concepts, fueling high market sentiment. The brand endorsement from Binance Alpha, the airdrop campaign, and the amplification effect from social platform X provide short-term upward momentum for $XNAP. Historical data shows that newly listed quality tokens can rise by 50%-200% in their first month due to speculative fervor. Based on $XNAP's initial price range ($0.03-$0.05), a short-term target of $0.15-$0.20 is not unattainable, especially if trading volume and community activity continue to increase. However, high volatility implies potential pullback risks, and investors need to closely monitor market depth and selling pressure.

The actual performance of the AI algorithms (e.g., the extent of transaction cost reduction, prediction accuracy) will directly impact user adoption. Early tests showed SnapX's smart routing could reduce costs by 15%-20%, but its effectiveness at scale needs verification.

SnapX plans to launch an NFT marketplace, cross-chain bridge, and decentralized lending protocol. The successful implementation of these features would significantly increase the use cases and demand for $XNAP.

How to Participate in $XNAP?

Visit the official Binance Alpha website, complete account registration and KYC verification to ensure eligibility.

Claim $XNAP by completing tasks (like trading, social media interactions, inviting friends) or by holding Alpha Points. Refer to the Binance Alpha announcement for specific rules.

Risk Warning: Cryptocurrency investment carries extremely high risks. It is advised to diversify investments, set stop-loss points, and avoid allocating all funds to a single project. Regularly monitor SnapX's roadmap updates and on-chain metrics to assess project progress.

Future Outlook: $XNAP's DeFi Ambitions

SnapX's goal extends beyond being just a trading platform; it aims to build a comprehensive AI-driven DeFi ecosystem. In the future, SnapX plans to introduce the following features:

Support for multi-chain trading across Ethereum, Solana, Binance Smart Chain, Polygon, etc., breaking the limitations of a single blockchain and expanding $XNAP's utility.

SnapX plans to integrate Decentralized Identity (DID) by 2026, using AI to verify user identities and enhance privacy protection and security.

If these goals are successfully achieved, SnapX has the potential to become a leader in DeFi 2.0, and $XNAP could rank among top DeFi tokens, similar to the market status of LINK or AAVE.

However, the key to success lies in technological execution and community support. SnapX needs to continuously optimize its AI algorithms to ensure stability under high-load scenarios, while maintaining community activity through transparent governance and incentive mechanisms. Investors should closely monitor SnapX's on-chain data, such as Total Value Locked (TVL), Daily Active Users (DAU), and trading volume growth. Additionally, community feedback on platform X and development team roadmap updates are important references for evaluating project progress.